South Korea imposes strict mortgage limits in Seoul

South Korea imposes strict mortgage limits in Seoul

Posted June. 28, 2025 07:07,

Updated June. 28, 2025 07:07

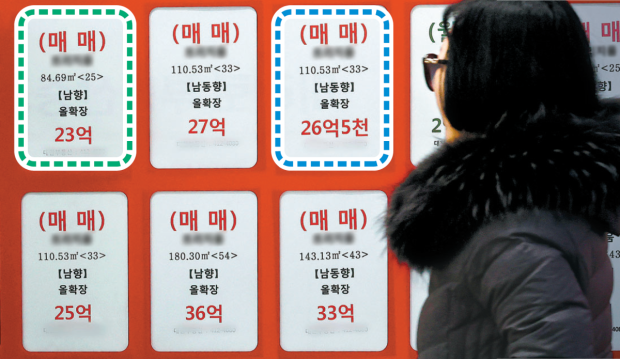

The South Korean government has introduced its first real estate policy under the new administration, unveiling some of the toughest mortgage regulations to date. Beginning Saturday, homebuyers in the Seoul metropolitan area will face a uniform cap of 600 million won on mortgage loans. New mortgage lending will also be entirely prohibited for owners of multiple homes in the region.

The move is aimed at cooling the overheated property market by preventing high-income earners and multi-homeowners from taking out excessive loans, a practice known as yeongkkeul, or “squeezing out every possible loan.”

The Financial Services Commission, along with the Ministry of Economy and Finance, the Ministry of Land, Infrastructure and Transport, and other agencies, announced the plan during an Emergency Household Debt Review Meeting on Friday. With housing prices in the Seoul area rising sharply less than a month into the new administration, the government moved quickly to respond.

This is the first time the government has imposed an absolute cap on individual mortgage loans, regardless of income level or home price. Effective immediately, loans over 600 million won are banned for home purchases in the Seoul metropolitan area. “This measure is intended to prevent the use of excessive loans for high-priced homes,” said an official from the financial authorities.

Multiple homeowners in the region will face even stricter rules. The loan-to-value (LTV) ratio for additional home purchases will be set at 0 percent, effectively banning all mortgage lending for non-owner-occupied properties.

This is the first time the government has imposed a fixed cap on individual mortgage loans, regardless of income or home price. Starting immediately, loans exceeding 600 million won will be banned for home purchases in the Seoul metropolitan area. “This measure is intended to prevent the use of excessive loans for high-priced homes,” said an official from the financial authorities.

Conditional loans for jeonse (lump-sum deposit leases) will also be banned, effectively ending “gap investment” strategies in which buyers use large jeonse deposits to purchase homes with minimal personal funds. “Unless the purpose is actual residence, loans from financial institutions will be blocked,” said a financial official.

“If necessary, we will immediately implement additional LTV tightening in regulated areas, expand the debt service ratio application to jeonse and policy loans, and increase risk weights on mortgage lending,” said Kwon Dae-young, secretary general of the Financial Services Commission.

Joo-Young Jeon [email protected]

![이준석 “국힘 대표 한동훈 유력…김용태 너무 소극적” [정치를 부탁해]](https://dimg.donga.com/c/138/175/90/1/wps/NEWS/IMAGE/2025/06/30/131910690.1.jpg)